How to Build A List of High-Fit Business Buyers & Acquirers

When owners decide to sell their company, one of the first things they consider is building a list of high-fit potential acquirers for the business. With private equity (financial) acquirers becoming so abundant in the last 10 years (over 2,500 in North America), the list of potential acquirers to approach in the sale process is likely to consist of both strategic and financial acquirers.

These two types of acquirers have fundamentally different goals and will approach your business from very different perspectives during an M&A sale process. In the process of identifying, evaluating and selecting the right acquirer for your business, you may want to engage representatives of both types of acquirers if you wish to maximize sales price and the probability of a successful transaction.

Key Types of Business Acquirers

Strategic Acquirer Insights: Benefits & Considerations

Strategic buyers are privately-held or public operating companies that provide products or services to the market in a certain sector. Strategic buyers represent about 70 percent of the total M&A market. Often times, they are direct competitors, suppliers or customers of your business. They can also be indirect competitors, in close adjacencies, or contextually related to your company and looking to grow in new directions. Their goal is to identify companies whose products or services can synergistically integrate with their existing business- the concept that the value of two companies combined is greater than the sum of the separate individual parts (i.e., 1+1 =3).

Financial Acquirer Overview: Role & Impact

Financial buyers include private equity (PE) firms, venture capital (VC) firms, hedge funds, and family investment offices. These types of acquirers are in the business of putting their investors funds to work by buying companies, supporting their growth, and realizing a significant return on their investment. They do this by reselling the enlarged companies after a few years. These acquirers typically look for solid businesses with good management teams and strong growth opportunities in which they can deploy additional capital to drive growth that will lead to future exit opportunities. Their acquisitions comprise the remaining 30 percent of the M&A market.

Comparing Approaches: Strategic vs. Financial Acquirers

Understanding the end goals of both financial and strategic acquirers is essential to understanding how and why their approaches are different. In general, there are five ways in which their considerations differ: 1) valuation of the business; 2) investment merits of the industry; 3) strength of infrastructure; 4) impact of investment horizon; and 5) transaction efficiencies. Each difference highlights its importance as to why one buyer category is more desired than the other.

Business Integration: Strategic Acquirers vs. Maintaining Independence

Strategic acquirers will most likely integrate the seller’s business into their own organization structure, business systems, controls, and management, after a transaction. This is so they can take advantage of the synergies that represented the rationale for the acquisition. Strategic acquirers often plan to fully integrate the seller’s company into the acquirer over time which can present a challenge for sellers that strongly value an independent organization and an ability to independently shape the organizational direction. In cases in which this is a significant issue, financial acquirers can represent an attractive alternative. This is because financial acquirers often provide the companies they acquire with a slightly greater degree of freedom on how to operate and grow the business.

Additionally, financial acquirers are often more likely to keep the seller’s current management team in place. In comparison, strategic acquirers tend to be more likely to insert their own leadership in the seller’s organization. As such, strategic buyers tend to emphasize their focus on the integration of the sellers’ business into their own and the achievability of the identified synergies, while financial acquirers tend to focus on the sustainability of the sellers’ existing business model, strength of the management team, and achievability of near-term growth opportunities.

Valuation Perspectives: How Acquirers Determine Worth

With such different rationales for completing an acquisition, it is not surprising strategic and financial acquirers view the valuation of the seller’s company in very different ways.

The purchase price strategic acquirers are willing to pay is significantly driven by their “post-acquisition economics”. Simply put, this means how much money they project they are going to make in the next 3-5 years of owning the company and how reasonable their assumptions are that must be true for those opportunities to be realized. Synergistic benefits after closing often include a number of cross-selling opportunities, leveraging of distribution channels, elimination of duplicative expenses, and economies of scale.

Other common integration synergies targeted by strategic acquirers include the following:

- Unlocking underutilized assets

- Access to proprietary technology

- Increased market power

- Shoring up weaknesses in key business areas

- Geographical or other diversification

- Providing an opportunistic work environment for key talent

- To reach critical mass for an IPO or achieve post-IPO full value

- Vertical integration

The greater incremental profit contribution derived from the integration synergies, the greater ability for the strategic acquirer to logically justify paying a premium purchase price.

Without the benefit of integration synergies, a financial acquirer’s valuation perspective is limited to two major factors: the seller’s current financial results and the ability for the seller’s company to achieve near-term growth opportunities. As a result of a financial acquirer’s lack of integration synergies, historically, strategic acquirers were expected to have the capability to pay higher purchase prices than financial acquirers. However, as the number of financial acquirers has swelled in the last 10 years, competition for quality companies has intensified. Financial acquirers have been forced to respond by paying premium purchase prices in-line with, or superior to, strategic acquirers.

Understanding what each type of buyer is seeking can help you tailor your company’s story to maximize purchase price and identify the acquirers who are the best fit for your situation.

Benefits of Engaging Both Strategic and Financial Acquirers

While the differences between strategic and financial acquirers are evident, it is uncommon for a situation to only be a fit for one or the other. It is recommended that you engage a large number of both potential strategic and financial acquirers. Aside from the obvious premium price benefits of fostering a highly competitive sale process, engaging both types of acquirers provides the seller with a greater range of options with which to achieve their specific objectives.

If you would like guidance to build your list of potential strategic and financial acquirers please contact [email protected]. We’d be happy to engage you in dialogue and explore why certain buyers make sense.

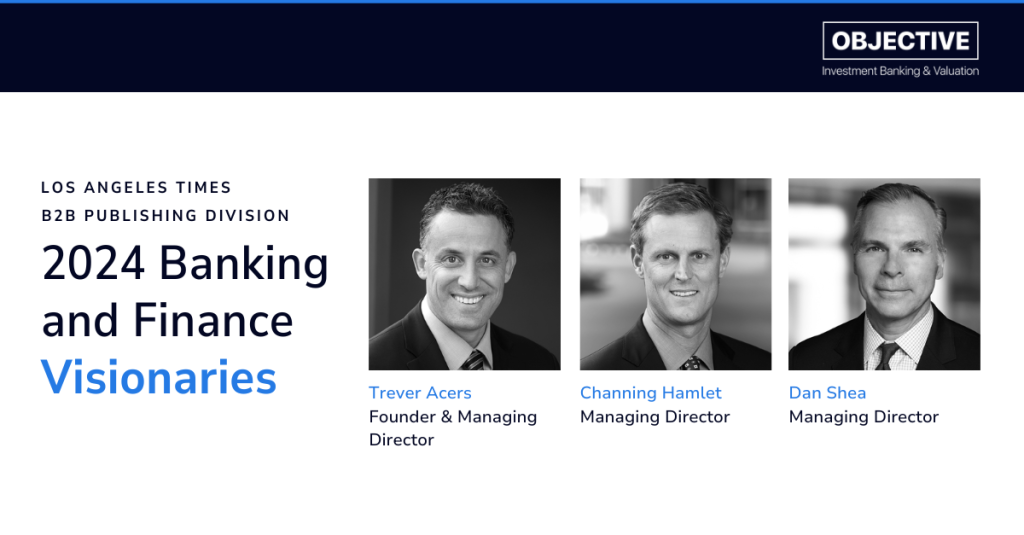

Get Expert Guidance on Acquirer Selection:

Managing Director

858.663.8662

Disclosure

This news release is for informational purposes only and does not constitute an offer, invitation or recommendation to buy, sell, subscribe for or issue any securities. While the information provided herein is believed to be accurate and reliable, Objective Capital Partners and BA Securities, LLC make no representations or warranties, expressed or implied, as to the accuracy or completeness of such information. All information contained herein is preliminary, limited and subject to completion, correction or amendment. It should not be construed as investment, legal, or tax advice and may not be reproduced or distributed to any person. Securities and investment banking services are offered through BA Securities, LLC Member FINRA, SIPC. Principals of Objective Capital are Registered Representatives of BA Securities. Objective Capital Partners and BA Securities are separate and unaffiliated entities.