[vc_row][vc_column][vc_column_text]

San Diego, CA, May 26, 2022 — Objective, Investment Banking & Valuation, a leading middle market investment banking and valuation firm, is pleased to announce that it served as the exclusive sell-side advisor to Kirei in its sale to Carnegie Fabrics, a portfolio company of Calera Capital. Kirei is a manufacturer and designer of aesthetically beautiful and sustainable acoustic solutions. This acquisition will expand and strengthen Carnegie’s range of acoustic design solutions, and will further enable them to provide a comprehensive assortment of solutions for all acoustic space management needs.

Since 2002, Kirei has worked with interior designers, architects, contractors, and end users across North America to help them create elegant, healthy spaces to live, work and play. Along with iconic design, sustainability is paramount for Kirei and is a critical component in their offerings which include wall and ceiling design elements manufactured using recycled PET plastic, helping to keep over 230 million plastic bottles from the landfill or oceans so far. Most recently, Kirei introduced their most sustainable product yet, the Air Baffle. The Air Baffle is made from EchoPanel® recycled PET, a registered trademark of Woven Image®, and filled with Nike Grind fluff, from shoe manufacture waste products. With the addition of the Air Baffle acoustic solutions, the acquisition of Kirei allows Carnegie to enhance its already strong commitment to environmentally focused innovation.

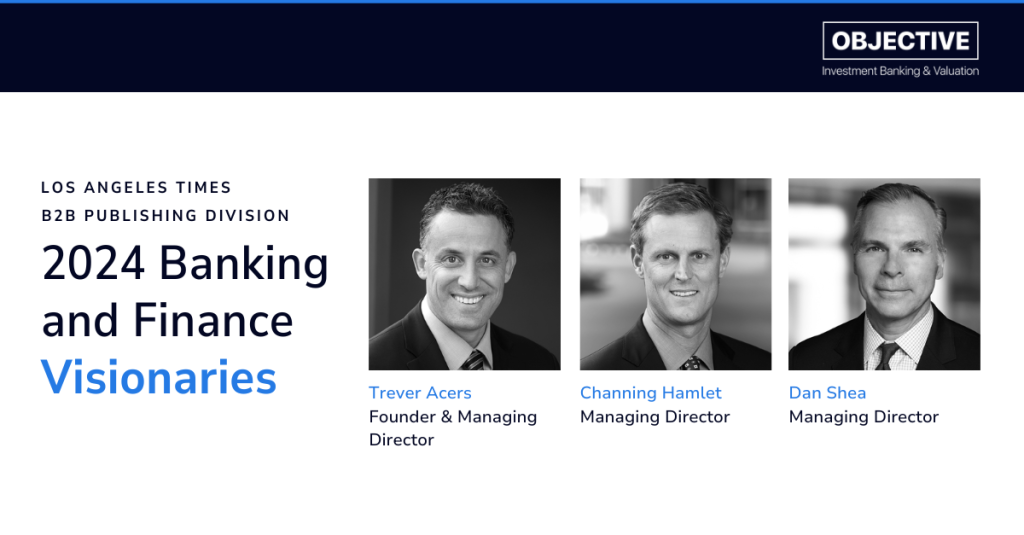

“We are grateful to have helped the Kirei Team identify the ideal partner for their next phase of growth and success” said Channing Hamlet, Managing Director at Objective.

“This feels like a very natural step to take Kirei’s growth to the next level. Partnering with Carnegie will ensure a broader audience is exposed to Kirei’s great products. Kirei’s PET product perfectly complements the Carnegie Xorel Artform and WOOD-SKIN ranges – delivering a comprehensive solution, whatever the acoustical management need. I’m also delighted that there is such a strong alignment of the two companies’ commitment to ongoing, environmentally focused innovation”, said Kirei Executive Vice Chairman, John Stein.

Carnegie CEO, Gordon Boggis, commented “Carnegie has a strong commitment to environmentally focused innovation. We have also seen great success with our Xorel Artform and WOOD-SKIN acoustical solution products. Kirei’s heritage is also very much about environmentally sustainable solutions, so the combination was a natural alignment of like-minded, purpose-driven companies. Adding Kirei to the Carnegie family delivers a comprehensive range of solutions for all acoustical space management needs.”

John Stein, the President and founder of Kirei will stay on in the role of Executive Vice Chairman of Kirei. In this role, John will focus on key strategic initiatives such as innovation, product pipeline, brand building and major business development projects.

About Objective, Investment Banking & Valuation

Objective, Investment Banking & Valuation is an internationally recognized investment banking and valuation firm serving lower middle market companies. Our Investment Banking Group primarily focuses on sell-side transactions within its five industry practice groups: Business Services, Consumer, Healthcare & Life Sciences, Manufacturing & Distribution, and Technology. Objective is tenaciously invested in providing business owners world-class, sector-focused advisory services solely focused on their objectives. For more information, please visit www.objectiveibv.com.

About Kirei

Kirei designs and manufactures iconic architectural design elements that improve the acoustics and functionality of any room. Since 2002, the company has worked with interior designers, architects, contractors, and end users across North America to help them create elegant, healthy spaces to live, work and play. Their products are easy to understand, specify and install, and are made from recycled materials. Kirei’s mission to “Inspire a Beautiful World” is seen through its commitment to sustainable materials and innovative design. For more information, visit www.kireiusa.com.

About Carnegie

Carnegie is a leading manufacturer and innovator of sustainable textiles and space management solutions for building interiors. A leader since 1950, the company has established a tradition of firsts, including the development of its own Xorel® fabrics, which provide a durable alternative to PVC materials and Biobased Xorel, the first plant based high performance textile in the world. In addition, Carnegie has built a reputation for its ongoing and comprehensive commitment to the environment through all parts of its business cycle by being a member of the Be Original organization, maintaining a B Corp certification, and by establishing themselves as the first and only interior textiles PVC-free company in the industry. For more information, visit www.carnegiefabrics.com.

—

For Immediate Inquiries:

Managing Director, Investment Banking

(310) 570‑2721

Disclosure

The above testimonials may not be representative of the experience of other customers and is not a guarantee of future performance or success.

This news release is for informational purposes only and does not constitute an offer, invitation or recommendation to buy, sell, subscribe for or issue any securities. While the information provided herein is believed to be accurate and reliable, Objective Capital Partners and BA Securities, LLC make no representations or warranties, expressed or implied, as to the accuracy or completeness of such information. All information contained herein is preliminary, limited and subject to completion, correction or amendment. It should not be construed as investment, legal, or tax advice and may not be reproduced or distributed to any person. Securities and investment banking services are offered through BA Securities, LLC Member FINRA, SIPC. Principals of Objective Capital are Registered Representatives of BA Securities. Objective Capital Partners and BA Securities are separate and unaffiliated entities.

[/vc_column_text][/vc_column][/vc_row]