Objective Capital’s Channing Hamlet to present at Southern California Institute

San Diego, CA- June 26, 2017 – Objective Capital Partners, a leading M&A investment banking firm specializing in middle market M&A and capital raise, healthcare & life sciences and valuation advisory services, is pleased to announce that one of its Managing Directors, Channing Hamlet, will be a panel speaker as part of Southern California Institute’s (SCI) Thursday Insights on July 6, 2017. Greg Banner of Asset Preservation Strategies, Inc. will join Mr. Hamlet in presenting Important Considerations in the Sale of Your Clients Business. In this session, Greg and Channing will cover a number of core concepts that advisors can use to advise clients at this critical juncture in their personal and business life. Specifically, they will discuss methods to maximize sale price, assess the sale for fit with client’s objectives, and methods to maximize after-tax cash.

The presentation is part of SCI’s Thursday Insights Program and is free for attendees. The Program is designed to provide a collaborative forum for professionals such as attorneys, accountants, bankers and financial advisors to come together and share knowledge, insights and practical know-how. It is also an opportunity to network with others and enjoy their fellowship. To RSVP for this program, call (858) 200-1911 or send an e-mail to [email protected]. More information on the event and SCI can be found at https://scinstitute.org/.

About South California Institute (SCI)

The Southern California Institute (SCI) was created in 2002 by a group of advisors in order to be able to offer education in a collaborative environment. SCI helps wealth advisors and clients through successful family and business owner events, wealth advisor education programs, wealth advisor partnering programs and speakers’ bureaus. More information on the Southern California Institute can be found at https://scinstitute.org/.

About Objective Capital Partners

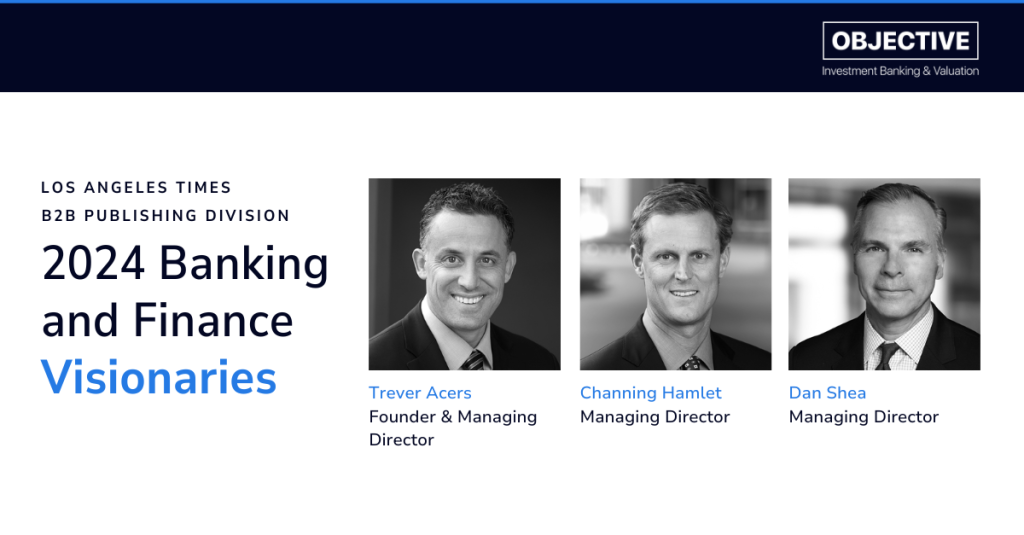

Objective Capital Partners is a leading M&A investment banking firm whose Principals have collectively engaged in more than 500 successful transactions serving the transaction needs of growth stage and mid-size companies. The executive team has a unique combination of investment banking, private equity, and business ownership experience that enables Objective Capital Partners to provide large enterprise caliber investment banking services to companies. The firm focuses on middle market M&A and capital raise activities for companies with enterprise values between $10-100 million, healthcare & life sciences and valuation advisory services. The firm’s industry expertise includes: software and hardware technology, life sciences, business services, IT services, healthcare services, biotech, consumer products and specialized manufacturing. Securities and investment banking services are offered through BA Securities, LLC Member FINRA, SIPC. Channing Hamlet and other Principals of Objective Capital are Registered Representatives of BA Securities. Objective Capital Partners and BA Securities are separate and unaffiliated entities. Additional information on Objective Capital Partners is available at www.objectiveibv.com.

Disclosure

This news release is for informational purposes only and does not constitute an offer, invitation or recommendation to buy, sell, subscribe for or issue any securities. While the information provided herein is believed to be accurate and reliable, Objective Capital Partners and BA Securities, LLC make no representations or warranties, expressed or implied, as to the accuracy or completeness of such information. All information contained herein is preliminary, limited and subject to completion, correction or amendment. It should not be construed as investment, legal, or tax advice and may not be reproduced or distributed to any person.

# # #

Objective Capital Partners Contact:

Mandy F. Woods

Business Office Manager

Objective Capital Partners

Tel: 858-208-3442